OPINION –

UnitedHealthcare CEO Brian Thompson was fatally shot outside a midtown Manhattan Hilton hotel at 6:46 a.m. Wednesday morning in what authorities are calling a targeted attack.

The assassin, who authorities report used a silencer on his firearm, allegedly waited outside the hotel for Thompson to arrive.

UnitedHealthcare, the insurance arm of UnitedHealth Group, is the country’s largest private health insurance provider.

The 50-year-old CEO was set to speak at UnitedHealth Group’s annual Investor Conference at 8 a.m., which was canceled following the homicide.

According to a November 26 press release on the company’s website, leaders were expected to “discuss the company’s long-term strategic growth priorities and its efforts to advance high-quality health care.”

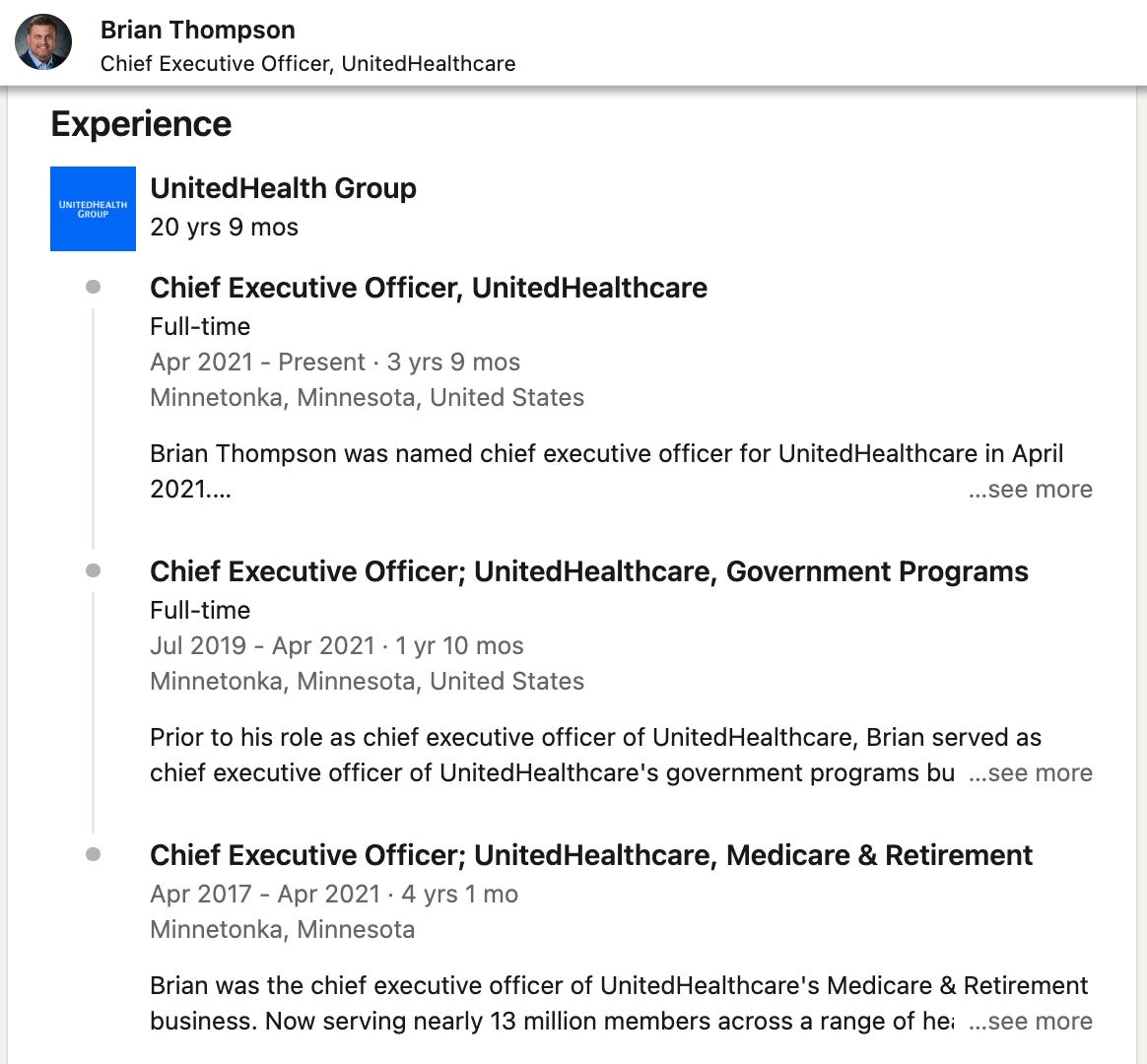

Thompson was a seasoned executive at the company. He boasted nearly 21 years with UnitedHealth Group, including CEO roles of government-affiliated branches “Medicare & Retirement” and “Government Programs.”

According to Quiver Quantitative (who writes code to track government spending), UnitedHealth is the second largest benefactor of the Biden administration (behind Lockheed Martin, ahead of Boeing), having received $98.3 billion during Biden’s term.

It appears, however, that the company’s relationship with the admin has been rocky as of late.

DOJ investigations

Attorney General Merrick Garland said, “The Justice Department will not hesitate to check unlawful consolidation and monopolization in the healthcare market that threatens to harm vulnerable patients, their families, and healthcare workers.”

UnitedHealth had already been on the DOJ’s radar, which also launched an antitrust investigation against the health conglomerate in February regarding their Optum Health unit.

It appears UnitedHealth had been up to antitrust activity for some time, noted by one X user in January 2023:

Shady stock trading

A class action lawsuit filed by UnitedHealth Group shareholders in May alleges that although the company knew of the antitrust investigation “since at least October 2023,” they did not disclose the motion to investors or the public.

The lawsuit further states “UnitedHealth insiders instead sold more than $120 million worth of their UnitedHealth (NYSE:UNH) shares. In the four months between learning about the DOJ investigation and the investigation becoming public, UnitedHealth’s Chairman Stephen Hemsley sold over $102 million of his personally held UnitedHealth shares, and Brian Thompson, the CEO of UnitedHealthcare, sold over $15 million of his personally held UnitedHealth shares.

Yahoo Finance reported in August that Thompson had sold 48% of his shares.

Fonder memories

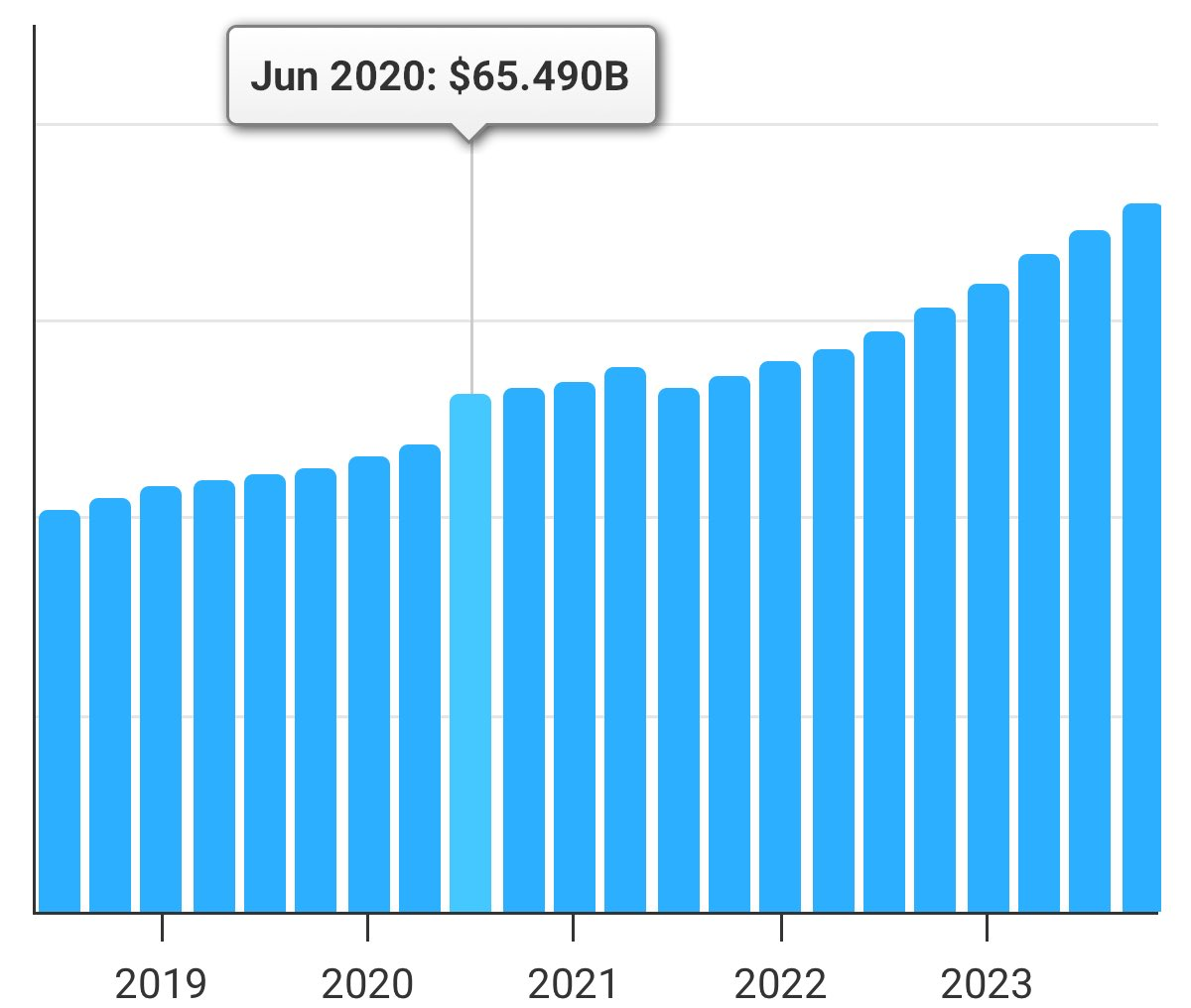

In fact, UnitedHealth has been enjoying increased profits, especially since the Covid-19 pandemic in 2020.

Pandemic profits

This revenue would come from increased doctor visits and Covid-19 vaccinations.

UnitedHealth incentivized physicians to see more patients, especially the elderly, by offering $10,000 bonuses and maintaining leaderboards.

The company also allegedly hid data on morbidity rates for Covid-19 versus the vaccine and fired employees who refused to get vaccinated.

Inconvenient truths

Just a couple days before Brian Thompson’s assassination, the Committee on Oversight and Accountability released a report that confirmed multiple Covid-19 “conspiracy theories,” including:

- Covid-19 originated from a lab, likely the Wuhan Institute of Virology

- The NIH had funded Dr. Fauci’s gain-of-function research at the Wuhan lab

- US and Chinese governments collaborated to cover-up the pandemic’s origins.

Was that $98.3 billion investment in UnitedHealth under the Biden administration tied to a dirty Covid game?

Per the Washington Post, former Medicare administrator Donald Berwick urged lawmakers to “investigate UnitedHealth’s growing role in managing Medicare plans or how the company fills out paperwork to get reimbursed. ‘They became the best at playing the game of charging the federal government more and using that wealth to gain political power, advertising power, some changes in benefits.’”

Follow the money?

They say that if you want to know the truth, you should follow the money.

International Business Times reports that a few separate entities picked up a great deal of UnitedHealth shares ahead of the assassination:

In Q3, Parsifal Capital Management LP acquired 36,200 shares valued at $21.16 million, making UnitedHealth Group their 15th largest holding, reported Market Beat.

Other institutional investors, like Delta Financial Group Inc. own 1,650 shares of the stock after buying 17 more valued at $965,000.

Another institutional investor, Fiduciary Group LLC, also bought an additional 18 shares increasing its stake by 0.5. It owns 3,695 shares that are valued at $1,882,000, said the site.

It could be something or it could be nothing, but this story is surely still developing.

Comments are closed.